Meister der Apokalypsenrose der Sainte Chapelle/Wikimedia

“In this world nothing can be said to be certain, except death and taxes,” Benjamin Franklin once wrote. But taxes actually are a relative newcomer in our history, write University of Washington sociologist Edgar Kiser and graduate student Steven M. Karceski in a review, “Political Economy of Taxation.” We asked Kiser, who studies what motivates people to fight wars or cooperate as nations, and other factors that shape society, to explain why taxes came to be, and how they’re likely to evolve. This interview has been edited for length and clarity.

Let’s start with a really broad question: Why, historically, have societies collected taxes?

It’s complicated, because people have collected taxes for different reasons. Looking at the big picture, one way it goes down is that people collect taxes because they have more power than other people. In lots of early societies, kings and nobles would take money from peasants. They had no justification for it. They didn’t tell the peasants they’d provide any sort of public goods. The money went into their big castles, or their wars, which benefitted themselves and a small group of nobles.

The way we like to think about it now — and the basis of a lot of economic models of taxation — is that societies collect taxes to provide goods that are more efficiently delivered by the state than by the market. These are things like national defense, infrastructure, education and law enforcement.

Where and when did people first collect taxes?

We don’t know a whole lot about early taxation. The evidence appears in little bits and pieces. I once went to a classics conference where people took little pottery shards and pieces off of papyrus and tried to make big arguments about what the tax system used to be. It was kind of crazy.

The first taxes about which we have actual data were those collected in Egypt, maybe 3,000-ish years BC. The pharaohs collected taxes through forced labor — for instance, they made subjects build pyramids — or they collected a chunk of the produce, such as 20 percent of the wheat that was grown. This seems to be the type of taxation early empires and premodern principalities employed, all around the world. They didn’t collect much. With the exception of a few outliers — like Athens or Rome at certain times in history — they didn’t get above 5 percent of GDP [Gross Domestic Product].

Why couldn’t premodern leaders collect more?

The tax base just wasn’t there. Populations were small and agrarian, and administrative capacity was extraordinarily limited. The French king, for instance, had no idea what was happening out in Brittany. The sultan of the Ottoman Empire, similarly, had no idea what was happening in the Balkans. They had to just take what they could.

Also, not too many services were being provided by the state. Prior to, say, the nineteenth century, rulers mostly just fought wars. All the welfare stuff, education stuff, infrastructure stuff wasn’t there — so there was no real need for taxes.

You write that everything changed over the course of the nineteenth century. What happened then?

Several things, including the growth of industrial capitalism. When people built the railroads, for example, it shortened land-based distances for the first time in human history. Before that, everyone got around on horses. You couldn’t travel by land any faster in the eighteenth century than you could during the Roman Empire.

Technologies like the railroads aided the development of communication, transportation and especially record-keeping. Now, for the first time, the person governing in France did have a pretty good idea of what was going on in the edges of the country. For the first time, he could tax income directly, because he actually knew how much people were making.

The demand for public services also dramatically increased. Modern France needed infrastructure and education, because lots of jobs required them. At the same time, democracy arose. That made it easier to make and enforce contracts between rulers and the people.

How so?

Even before democracies emerged, there was always an understanding, sometimes very explicit and sometimes not, of what was going to get paid, and what was going to be received in return.

In feudal systems in Europe, aristocrats generally owed the king 40 days and nights of service, a certain number of horses and a certain amount of equipment. The king would call them, and they would show up with their horses and guys, and their spears or crossbows or whatever it was they had, and fight a war. In exchange, they were allowed to use land. Peasants paid taxes, and received protection from the crown — albeit something kind of like Mafia protection.

As time went on and regular people got an increasing voice in government, the contract became more explicit and more equitable — spelled out in written constitutions and enforced at the ballot box. Before, the only means of enforcement, from the peasants’ point of view, was revolt. Today, people tend to think, if you pay your taxes, the potholes get filled. There are certain things we expect the state to do, in exchange for our payment of taxes.

So how much did tax revenues increase with modernization, and the solidification of this social contract?

By 1900 or so, a lot of developed states had moved from getting about 5 percent to about 10 percent of GDP from taxes. That moves up again to about 20 percent of GDP as World War I gets going. You start to see accelerating increases, carried along by both world wars and by the Great Depression, which dramatically boost the need for social welfare expenditures of many kinds.

In 2010, tax revenues were 45 percent of GDP in Denmark but only 23 percent of GDP in the United States. Why does such a vast difference exist?

One problem today is that most taxes are paid into a general fund, and are spent in a bunch of different ways. There’s not a close relationship, as there was throughout most of human history when most taxes were done through a process we now call earmarking, where there’s a direct connection between a particular tax and the particular benefit a taxpayer gets in return. In terms of that economic contract I talked about earlier, it’s now very hard for most of us to conceive of whether we’re getting a good deal on our taxes or not.

And so paying in at high levels only happens when there is a lot of trust. In Scandinavia and other parts of Europe, they’ve been able to develop that. They have single-body legislative systems, which give leaders fewer chances to scuttle tax proposals and force them to work toward consensus. In the United States, it’s the opposite: We have two federal law-making bodies, which helps give legislators whose constituents oppose a particular tax many opportunities to kill it — and few incentives to work with differently minded colleagues to adapt it. Going back to earmarking would be, I think, the only reasonable way that the United States could increase taxes.

Taxation levels are low in Asia, too — in 2010 just 29 percent of GDP in Japan. Is that for the same reasons?

No, it’s because demand for welfare spending in Asia is much lower. Benefits are often provided by institutions outside of the state such as firms, churches or families. One of the major reasons you need welfare systems and unemployment benefits in the United States is that people get fired all the time. That’s not happening in Japan, where many companies have traditionally provided lifetime employment.

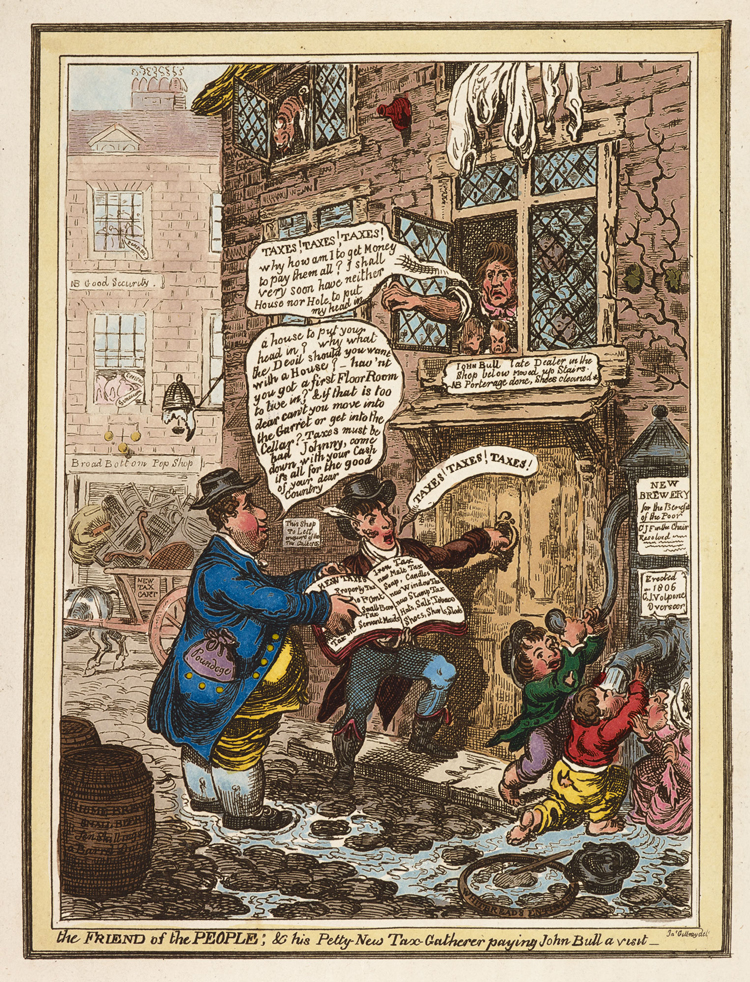

Tax collectors pay an unwelcome call on a London tradesman, as depicted by Georgian caricaturist James Gillray, ca. 1818.

British Library

You have suggested that progressive taxation, which taxes wealthier people at higher rates, may be disappearing. Why?

Progressive taxation is historically rare. Basically, it didn’t exist until the late nineteenth century, when the first income taxes in the U.S. applied only to the rich. It’s starting to fade away now in the U.S. Since Ronald Reagan was in office, the American tax system has gotten less and less progressive. (It’s still more progressive than systems in many social democracies in Europe, though.)

A friend of mine, Monica Prasad of Northwestern University, argues that progressive taxation is founded upon, and tends to increase, class antagonisms. A big reason we had early progressive taxation in the United States was that the Populist movement wanted to soak the rich in various ways. But this is unstable, because it leads to conflict with a group that’s powerful in society. Rich and powerful folks who feel attacked avoid paying their taxes.

In the contemporary world, it’s getting more and more difficult to tax wealthy people. The main thing rich people had in premodern times was land — they couldn’t pack it up or hide it. But now, assets are so mobile, so easy to hide, that if your orientation is taxing mostly rich people through progressive taxation you’re going to have high tax evasion. It’s hard to imagine a way out of that.

Why not just pursue the evaders?

It’s extraordinarily difficult to prevent wealthy people from hiding their assets. The EU tried to do it a little bit. My sense is that it’s more or less impossible.

So what’s the answer?

High-tax and high-benefit social democratic societies like Sweden and Denmark have relied for a long time on a sort of taxation that isn’t very progressive at all. Basically, their idea is, you tax practically everybody at a relatively high rate, and then everybody gets benefits.

It’s not a system that’s trying to transfer money from rich people to poor people. Many scholars believe it is a much more effective and stable system.

Would such a system work in the United States?

It’s unclear. Sweden used to be, 30 years ago, an entirely homogenous society. Now something like 12 percent or 13 percent of its population is foreign-born — and many scholars are arguing that this increased diversity is leading to decreased acceptance for high levels of public spending. Taxation support falls apart when people don’t think they or ‘their people’ will benefit from the services that taxes provide. It’s a sad fact that many of us only want money to be spent on stuff for people like us.

There’s a fairly new and ongoing debate about this. Many people suggest that you’re unable to have both a large welfare state and open borders at the same time. You’ve got to pick.

What do you think is going to happen?

We could move toward a social democratic solution, like the systems in Sweden or Denmark. That would be what I’d like to see. The other possibility is we go back to almost a semi-feudal situation. We would have a few rich people who pay hardly anything in taxes and get lots of benefits from the state, and everyone else would pay all the taxes.

If our political system continues to work as poorly as it’s working now, I could imagine that kind of future.

For the record: This article was updated October 28, 2017, to correct an error. The original language (“By 1900 or so, a lot of developed states had moved from getting about 5 percent to about 10 percent of their revenue from taxes. That moves up again to about 20 percent of revenue as World War I gets going.”) was replaced with “By 1900 or so, a lot of developed states had moved from getting about 5 percent to about 10 percent of GDP from taxes. That moves up again to about 20 percent of GDP as World War I gets going.”