The year 2023 was a big one for climate news, from record heat to world leaders finally calling for a transition away from fossil fuels. In a lesser-known milestone, it was also the year the European Union soft-launched an ambitious new initiative that could supercharge its climate policies.

Wrapped in arcane language studded with many a “thereof,” “whereas” and “having regard to” is a policy that could not only help fund the European Union’s pledge to become the world’s first carbon-neutral continent, but also push industries all over the world to cut their carbon emissions.

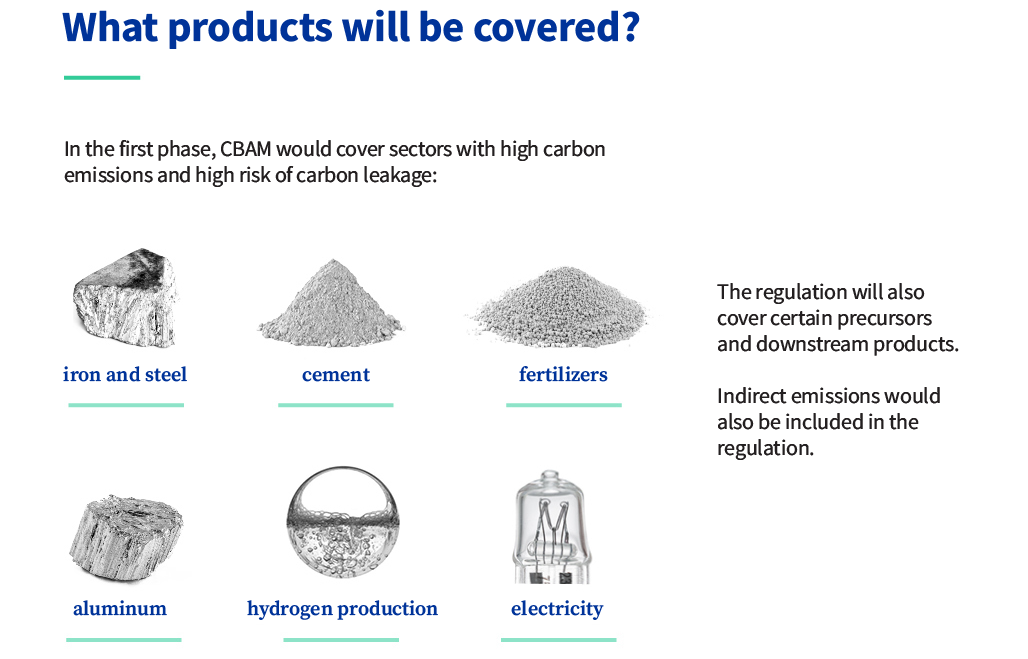

It’s the establishment of a carbon price that will force many heavy industries to pay for each ton of carbon dioxide, or equivalent emissions of other greenhouse gases, that they emit. But what makes this fee revolutionary is that it will apply to emissions that don’t happen on European soil. The EU already puts a price on many of the emissions created by European firms; now, through the new Carbon Border Adjustment Mechanism, or CBAM, the bloc will charge companies that import the targeted products — cement, aluminum, electricity, fertilizer, hydrogen, iron and steel — into the EU, no matter where in the world those products are made.

These industries are often large and stubborn sources of greenhouse gas emissions and addressing them is key in the fight against climate change, says Aaron Cosbey, an economist at the International Institute for Sustainable Development, an environmental think tank. If those companies want to continue doing business with European firms, they’ll have to clean up or pay a fee. That creates an incentive for companies worldwide to reduce emissions.

In CBAM’s first phase, which started in October 2023, companies importing those materials into the EU must report on the greenhouse gas emissions involved in making the products. Beginning in 2026, they’ll have to pay a tariff.

Even having to supply emissions data will be a big step for some producers and could provide valuable data for climate researchers and policymakers, says Cosbey.

“I don’t know how many times I’ve gone through this exercise of trying to identify, at a product level, the greenhouse gas intensity of exports from particular countries, and had to go through the most amazing, torturous processes to try to do those estimates,” he says. “And now it’s going to be served to me on a plate.”

CBAM will apply to a set of products that are linked to heavy greenhouse gas emissions.

CREDIT: ADAPTED FROM EUROPEAN UNION AND THE COUNCIL OF THE EU

Side benefits at home

While this new carbon price targets companies abroad, it will also help the EU to pursue its climate ambitions at home. For one thing, the extra revenues could go toward financing climate-friendly projects and promising new technologies.

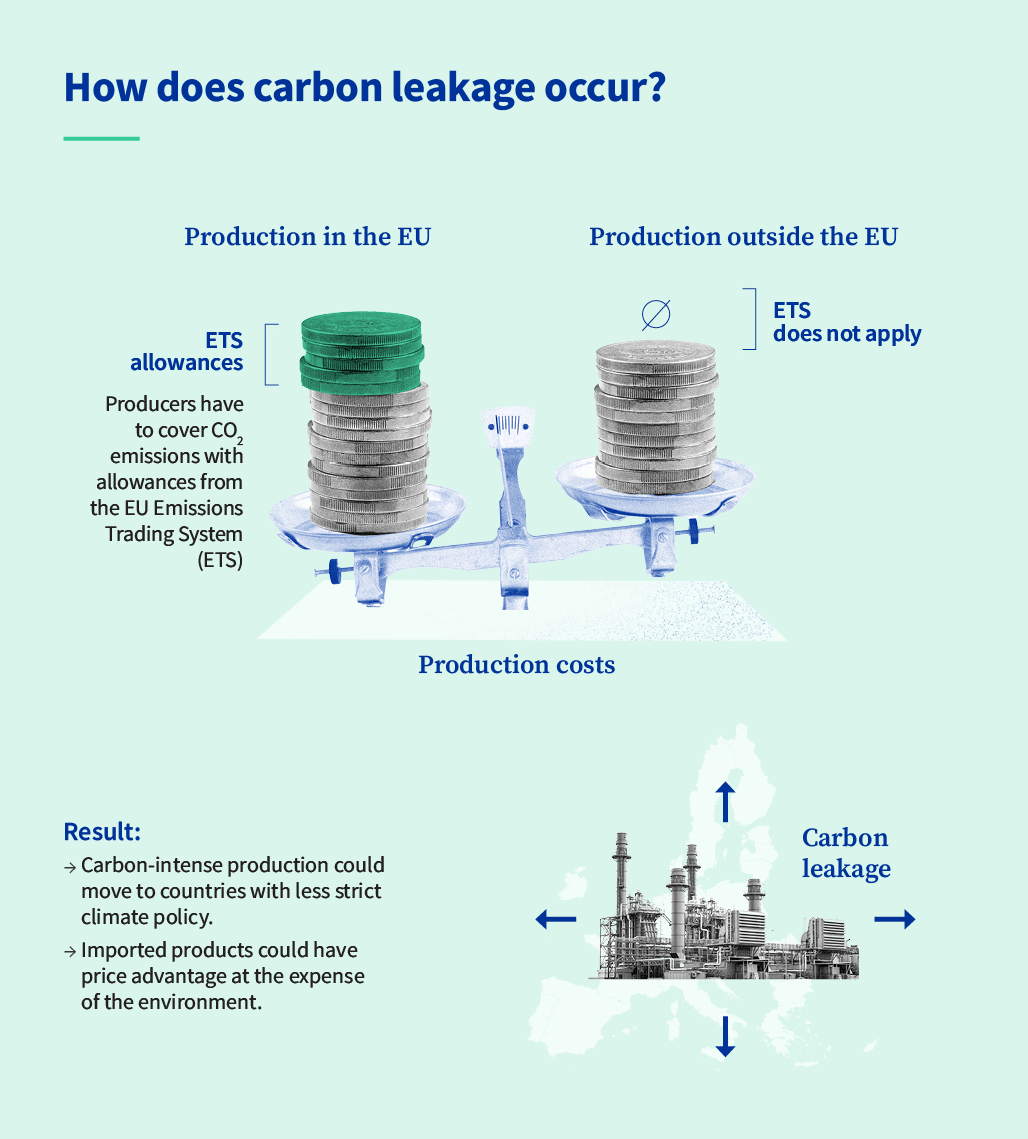

But it also allows the EU to tighten up on domestic pollution. Since 2005, the EU has set a maximum, or cap, on the emissions created by a range of industrial “installations” such as oil and metal refineries. It makes companies within the bloc use credits, or allowances, for each ton of carbon dioxide — or equivalent discharges of other greenhouse gases — that they emit, up to that cap. Some allowances are currently granted for free, but others are bought at auction or traded with other companies in a system known as a carbon market.

But this idea — of making it expensive to harm the planet — creates a conundrum. If doing business in Europe becomes too expensive, European industry could flee the continent for countries that don’t have such high fees or strict regulations. That would damage the European economy and do nothing to solve the environmental crisis. The greenhouse gases would still be emitted — perhaps more than if the products had been made in Europe — and climate change would careen forward on its destructive path.

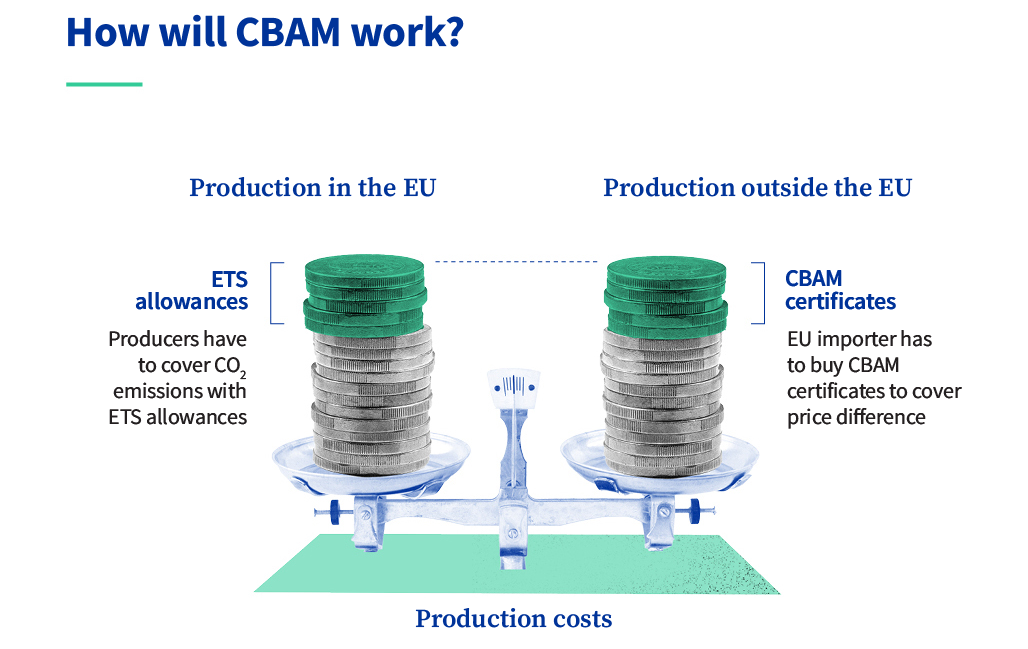

The Carbon Border Adjustment Mechanism aims to impose the same carbon price for products made abroad as domestic producers must pay under the EU’s system. In theory, that keeps European businesses competitive with imports from international rivals. It also addresses environmental concerns by nudging companies overseas toward reducing greenhouse gas emissions rather than carrying on as usual.

This means the EU can further tighten up its carbon market system at home. With international competition hopefully less of a concern, it plans to phase out some leniencies, such as some of the free emission allowances, that existed to help keep domestic industries competitive.

That’s a big deal, says Cosbey. Dozens of countries have carbon pricing systems, but they all create exceptions to keep heavy industry from getting obliterated by international competition. The carbon border tariff could allow the EU to truly force its industries — and consumers — to pay the price, he says.

“That is ambitious; nobody in the world is doing that.”

This graphic explains why the Carbon Border Adjustment Mechanism — CBAM — was put in place. Before the new policy, materials made outside the bloc were not subject to the same greenhouse gas emissions fees as those made inside the EU. Starting in 2026, fees will apply to certain targeted materials brought into the EU wherever in the world they are made.

A push to get with the program

The new regulations include an important nudge to other governments. CBAM regulations state that if a company pays a carbon fee at home, it won’t also have to pay the EU — just the difference, if the EU’s price is higher. That creates a strong incentive for countries to impose their own price on carbon emissions so that they, and not the EU, get the revenue.

Indeed, a range of countries have begun weighing the possibilities for their own carbon border adjustments, many inspired by the EU’s plan. In December, the UK outlined plans for its own CBAM, and in January 2023, Taiwan passed into law a carbon fee that is meant to capture a significant chunk of the revenue that exporters would otherwise pay the EU. India, which has criticized Europe’s carbon border adjustment as hurting less-developed countries, is considering imposing a carbon price to avoid losing revenue to Europe.

This plan is wildly ambitious. So will it work? Ultimately, a great deal of CBAM’s success or failure will lie in the details. And there are a lot of them.

European industry is adamant that emissions reporting must be as stringent for overseas competitors as it is for them. “If you can’t do that, it is not going to work,” says Jostein Røynesdal, vice president head of group EU affairs at the Norwegian aluminum company Norsk Hydro.

And correctly calculating and reporting emissions, especially in countries that don’t currently require companies to track that information, can be complicated, Røynesdal says. In the case of aluminum, manufacturers can easily melt down scraps and use them to create new products, which creates tricky questions about how to measure emissions from recycled material. Plus, global supply chains create a host of complications. A business wanting to import, say, aluminum sheets into the EU might be an aluminum trader, not the producer itself, and that trader might have bought the sheets from another trader in a different country, who perhaps bought them from a local business with multiple suppliers. “The emission report has to travel several steps backward in the value chain,” Røynesdal says.

This graphic explains how CBAM will work.

To make things more complicated, the EU’s definition of emissions includes not just direct emissions from creating the product but also those from the electricity used to produce the goods. That means a business must understand the carbon emissions generated by its electric grid.

“It may not be the case that every country has this information available,” says Nuomin Han, who heads research on carbon markets at the consulting firm Wood Mackenzie.

For now, the EU has created estimates that companies can use if they don’t know their exact emissions. But plenty of companies will be eager to argue that those numbers don’t apply to them, says economist Christian Gollier of the Toulouse School of Economics, who coauthored a report in the 2023 Annual Review of Economics on the economic policies needed to fight climate change.

“I’m sure it will go to a judge at the World Trade Organization, sooner or later,” he says.

Consider the consumer

One of the greatest challenges facing CBAM — as with most climate policies — is the impact on consumers. Experts agree that many of the additional costs the policy imposes will get passed down to the person on the street, and prices will go up. Lower-income households will be especially hard hit since a greater share of their income is gobbled up when costs rise for electricity or other basic goods.

For that reason, Gollier argues that a substantial chunk — perhaps 20 to 30 percent — of the income from CBAM and Europe’s domestic carbon fees should go toward compensating the neediest consumers.

Indeed, while carbon pricing has been shown to reduce carbon emissions, its revenue-generating effects may prove to be one of its most important contributions, says ETH Zurich climate policy researcher Janna Hoppe, who coauthored an analysis of the effects of climate policies in the 2023 Annual Review of Environment and Resources. “Having some source of revenue that can be redistributed in order to make these policy instruments more just will always play a very critical role,” she says.

But a strong CBAM will be crucial if Europe plans to succeed in its climate ambitions, says Gollier. The EU has committed to cutting greenhouse gas emissions by 55 percent by 2030, compared to 1990 levels. To get there, Gollier says, pollution will have to become even more expensive for industry — perhaps two to three times what it is today.

In that environment, it will be crucial to have a carbon price that keeps European business alive by making companies abroad pay for their emissions, Gollier adds.

“If we fail in the CBAM — and it’s not completely clear that we will be able to succeed in implementing an efficient CBAM — forget about the climate ambition for Europe,” he says. “It’s completely vital.”