About 158 million Americans, including workers and their dependents, obtained health insurance through an employer in 2019. Then came the Covid-19 pandemic, sending the nation’s unemployment rate to a historic high of 14.8 percent in April 2020. The rate remains elevated — 6.7 percent as of December — compared with pre-pandemic levels.

So what happened to health coverage for all these people? Millions lost their insurance when jobs went away, but exactly how many is still far from clear, with estimates ranging from a low of 3.1 million Americans losing employer-sponsored insurance during 2020, to as many of 27 million. This would be in addition to the more than 35 million people who had no insurance at all in late 2019. Covid-19’s true effects on America’s uninsured rate will not be known until the government’s official insurance survey is completed later this year.

There are reasons for the lack of clarity. Some who lost jobs early in the pandemic have returned to work, and some may have enrolled in Medicaid or purchased insurance through the health-care marketplaces. Other people lost jobs and job-related insurance benefits later on during the pandemic. And though coverage may be available for many, “they have to go out and find it when a lot of other things in their lives are pretty complicated,” says economist Sherry Glied, dean of New York University’s Robert F. Wagner Graduate School of Public Service. “This has been one of those moments that has exposed the complexity of our health insurance system and the demands we put on people to manage that.”

Glied, who examined how the Affordable Care Act increased disease screenings and other aspects of preventive care in a 2018 article she coauthored in the Annual Review of Public Health, spoke with Knowable Magazine about whether America’s health insurance system is serving the country well during the pandemic. This conversation has been edited for length and clarity.

Remind us how Americans get health insurance.

The health insurance system in the United States is very complicated, but the easiest part of it is that people 65 and over all get their health insurance through Medicare. Most people under 65 get insurance through employers, either through their own job or the job of a family member, because spouses and kids can be covered under an employed person's job.

Another chunk of people who are low-income get health insurance through the Medicaid program, which is paid for in part by the federal government and in part by the states. Then there’s a small group of people who buy insurance on their own as individuals. Today, most of them are getting their coverage through the Obamacare marketplaces that were set up through the Affordable Care Act.

Then there is still a group of people who are uninsured. In 2019, about 10 percent were uninsured, according to the main survey from which we learn about health insurance. We won’t know how that changed in 2020 until those survey results are published later this year.

Based on what you see so far, do you think the health insurance system is serving us well during the pandemic?

You can see from my description of the whole system that there is a lot of potential for people to fall between the cracks, and Covid has increased the number of people who are in those spaces.

In December 2020, more than 10.7 million Americans were unemployed, up from the pre-pandemic level of 5.7 million in February of that year. With job losses, many Americans also lost their health coverage, although the exact counts aren’t clear.

Did anyone die of Covid-19 because of America’s fragmented health insurance system?

One reason that we have seen disproportionate Covid morbidity and mortality among low-income people is because of the high level of preexisting conditions — diabetes, high blood pressure, asthma and so forth — among that population. And that is partly because of a long history of people not having continuous health insurance and not having access to appropriate care.

We have always known that, of course. And Covid didn’t cause those preexisting conditions. But Covid has really brought to light the high level of those conditions that already existed.

Covid-19 has filled up our hospitals, so that’s one part of the economy that is benefiting from the pandemic, right?

Not necessarily. Those different insurance programs I listed pay doctors and hospitals very different rates. Medicare and, even more so, Medicaid, pay relatively low rates to hospitals and physicians. Private insurance that you get through your employer pays rates that can be up to three times as high as the rates paid by Medicare for the same service rendered in the same hospital.

Of course, this has been the case for a long time, but Covid-19 has showed us the downside of that. Because Covid is an infectious disease, it hits communities. And, when it hits a low-income community where a lot of people are uninsured or covered by Medicare or Medicaid, those people all rely on the same hospital, right? That hospital is getting low payment rates both for the Covid care and also for all the care those people had in the years coming up to this.

One of the concerns we have had for a while is that hospitals that are facing financial difficulty are closing or merging with other hospitals. There’s a big concern that Covid is causing more closures of rural hospitals and the safety-net hospitals that serve the poorest populations because they are unable to withstand the financial hit of the pandemic.

And we are worried about hospitals that merge. When hospitals consolidate, that makes it easier for them to charge more because they have less competition. And that drives up our health-care costs.

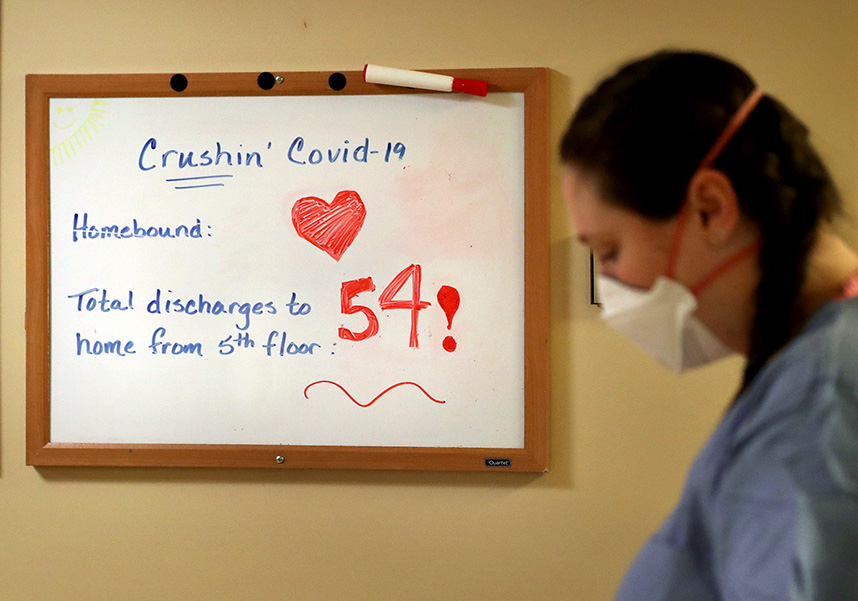

A whiteboard at Bethesda Hospital in St. Paul, Minnesota, in early May 2020, tallies the number of Covid patients discharged from a floor of the hospital. Repurposed as a Covid facility during the pandemic, the 137-year-old hospital was shuttered in November because the health system that owns it said it was facing $250 million in operating losses in 2020, exacerbated by Covid-19.

CREDIT: DAVID JOLES / STAR TRIBUNE VIA AP

How have insurance companies fared during the pandemic?

In a typical year, private insurance companies pay out a lot of claims on elective procedures like hip and knee replacements and back surgeries. Those companies have been doing very well during the pandemic because people stopped having those procedures. You wouldn’t think that a terrible pandemic causing loads of morbidity and mortality would actually reduce health-care spending and save insurance companies money, but that’s what happened. It’s very ironic.

This all seems pretty bad. Will Covid-19 be the tipping point for the US to move to universal health-care coverage like all the other developed countries?

People presume that there are really just two kinds of health-care systems in the world — the US system and the system used by the rest of the world — but that’s actually completely inaccurate. There are really no two countries that have the same system. For example, the system in England and the system in Germany are both universal health-care systems, but other than that, they have very little in common.

We may very well move to a system that is universal, like all the other countries in the world, but it won’t look like any of those other systems.

Health care in Canada and England seems so simple because everybody gets care. Why can’t we do what they are doing?

Canada’s system and England’s system are very different, but in both cases, there is a universal government-run system that supersedes everything else. So neither of those systems is likely to work in the US because Americans tend to be wary of government-run programs.

It’s more likely that we could get to universal coverage in a way that resembles, more closely, the models used in the Netherlands or Germany or Switzerland. In all those places, everyone is mandated to have insurance but the systems all work differently. In Germany, most people choose a plan from a big group of nonprofit insurers and coverage is paid for by both the workers and their employers. Unemployed people are covered by the government.

Or maybe we could move more towards a system like Australia. Citizens there are automatically enrolled in a universal public health insurance program that provides basic coverage for hospital and physicians, but the government offers a lot of financial incentives to encourage people to buy supplemental private insurance for better coverage — things like premium discounts for young adults, rebates for others and financial penalties for high-income earners who forgo supplemental coverage. About half of Australians have that extra coverage.

In the Netherlands and Switzerland, the insurance systems work differently, but both require citizens to buy coverage from competing nonprofit insurance companies or pay financial penalties. And people can buy extra coverage through private, often for-profit, insurance companies as well.

So why don’t we do something like that?

Just like in these other countries, providing several ways for people to acquire coverage was the model behind the Affordable Care Act (ACA). And we can imagine achieving universal coverage if all of the elements of the act had been put in place, including Medicaid expansion in every state. But 12 states have chosen not to participate.

I think that, over time, more and more states will participate in the Medicaid expansion. There’s just so much money on the table — the federal government will pay 90 percent of the cost for people covered by the expansion — that it’s hard for them to walk away from it. The Biden administration could presumably sweeten the deal so that more states would sign up, and that would get us part of the way towards achieving the vision of the people who designed the ACA.

One of the Biden administration’s first actions was to order a three-month special enrollment period this spring to encourage more people to buy coverage through the ACA marketplace. But we have learned that we probably also have to sweeten the subsidies that help people buy insurance through the marketplace. Currently, it’s still too expensive for many people. And the coverage they buy has so much cost-sharing in the form of deductibles and co-payments that it’s not actually that useful to some of the lower-income people and middle-income people who are buying it.

So I hope to see legislation to improve those dimensions of the coverage. We’ll see whether the Biden administration is able to get legislation like that through Congress.

Will we see universal coverage in the US in the foreseeable future?

Let’s say that I am pretty sure we will get to universal coverage in many of the states of the United States, although I’m not sure we will get to universal coverage in all the states. In some of the Northeastern states, we are very, very close to it already. If you don’t count undocumented residents, who are not typically insured in other countries either, states like Massachusetts are actually running very close to universal health insurance already.

So we know it can be done, and I hope that it will be done.

This article is part of Reset: The Science of Crisis & Recovery, an ongoing series exploring how the world is navigating the coronavirus pandemic, its consequences and the way forward. Reset is supported by a grant from the Alfred P. Sloan Foundation.