Radioactive drugs strike cancer with precision

The tumor-seeking radiopharmaceuticals are charting a new course in oncology, with promise for targeted treatments with fewer side effects

Support sound science and smart stories

Help us make scientific knowledge accessible to all

Donate today

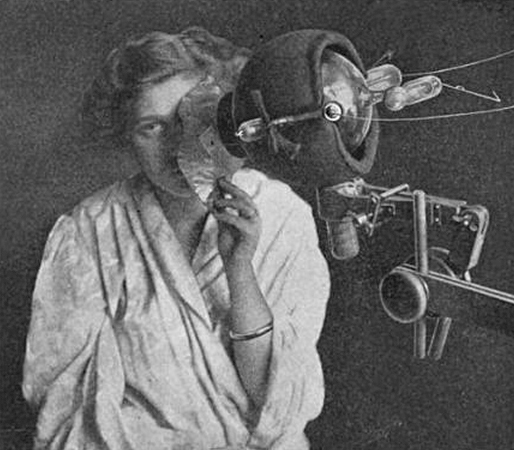

On a Wednesday morning in late January 1896, at a small light bulb factory in Chicago, a middle-aged woman named Rose Lee found herself at the heart of a groundbreaking medical endeavor. With an X-ray tube positioned above the tumor in her left breast, Lee was treated with a torrent of high-energy particles that penetrated into the malignant mass.

“And so,” as her treating clinician later wrote, “without the blaring of trumpets or the beating of drums, X-ray therapy was born.”

Radiation therapy has come a long way since those early beginnings. The discovery of radium and other radioactive metals opened the doors to administering higher doses of radiation to target cancers located deeper within the body. The introduction of proton therapy later made it possible to precisely guide radiation beams to tumors, thus reducing damage to surrounding healthy tissues — a degree of accuracy that was further refined through improvements in medical physics, computer technologies and state-of-the-art imaging techniques.

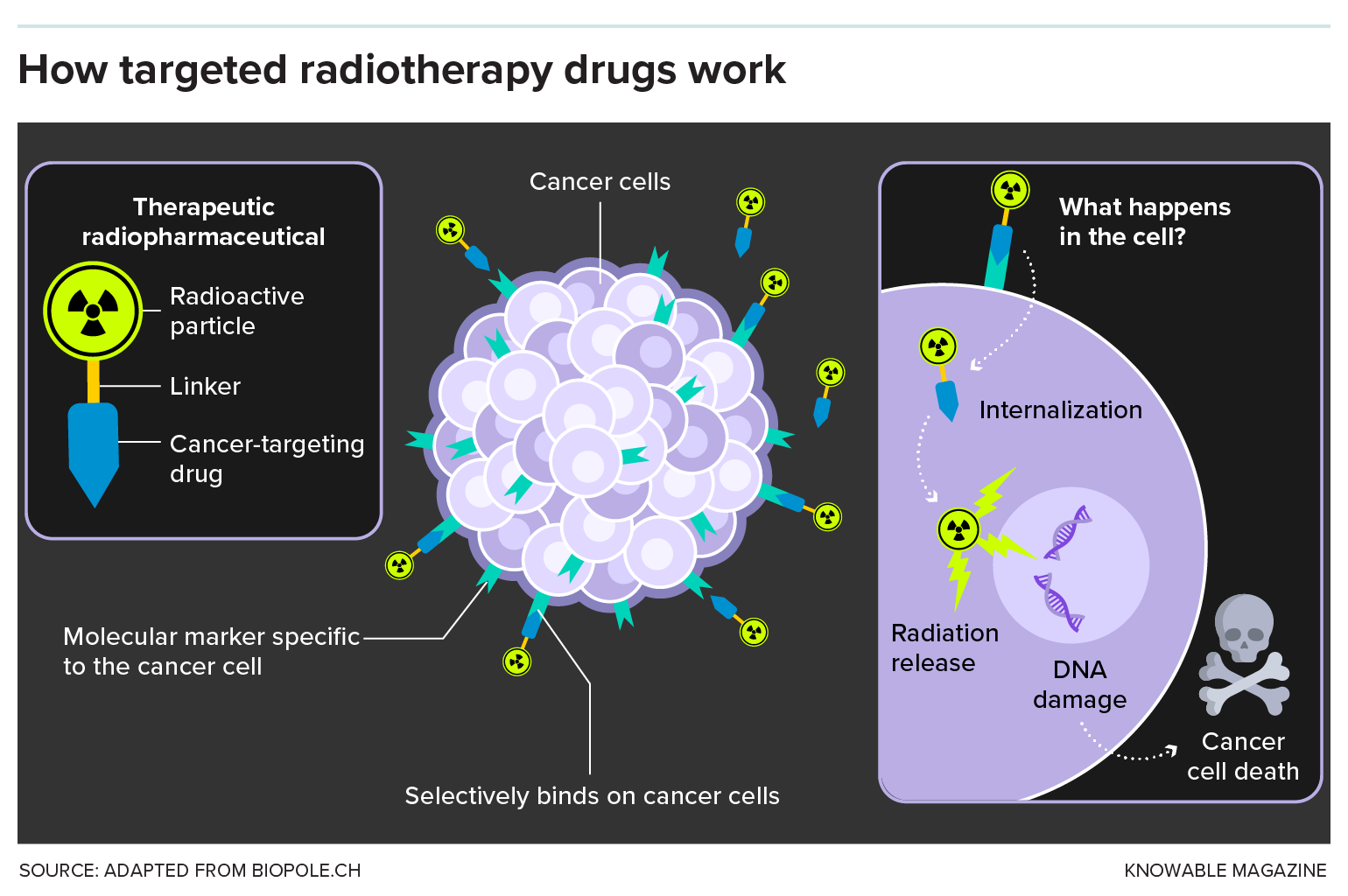

But it wasn’t until the new millennium, with the arrival of targeted radiopharmaceuticals, that the field achieved a new level of molecular precision. These agents, akin to heat-seeking missiles programmed to hunt down cancer, journey through the bloodstream to deliver their radioactive warheads directly at the tumor site.

Use of radiation to kill cancer cells has a long history. In this 1915 photo, a woman receives “roentgenotherapy” — treatment with X-rays — directed at an epithelial-cell cancer on her face.

CREDIT: WIKIMEDIA COMMONS

Today, only a handful of these therapies are commercially available for patients — specifically, for forms of prostate cancer and for tumors originating within hormone-producing cells of the pancreas and gastrointestinal tract. But this number is poised to grow as major players in the biopharmaceutical industry begin to invest heavily in the technology.

AstraZeneca became the latest heavyweight to join the field when, on June 4, the company completed its purchase of Fusion Pharmaceuticals, maker of next-generation radiopharmaceuticals, in a deal worth up to $2.4 billion. The move follows similar billion-dollar-plus transactions made in recent months by Bristol Myers Squibb (BMS) and Eli Lilly, along with earlier takeovers of innovative radiopharmaceutical firms by Novartis, which continued its acquisition streak — begun in 2018 — with another planned $1 billion upfront payment for a radiopharma startup, as revealed in May.

“It’s incredible how, suddenly, it’s all the rage,” says George Sgouros, a radiological physicist at Johns Hopkins University School of Medicine in Baltimore and the founder of Rapid, a Baltimore-based company that provides software and imaging services to support radiopharmaceutical drug development. This surge in interest, he points out, underscores a wider recognition that radiopharmaceuticals offer “a fundamentally different way of treating cancer.”

Treating cancer differently, however, means navigating a minefield of unique challenges, particularly in the manufacturing and meticulously timed distribution of these new therapies, before the radioactivity decays. Expanding the reach of the therapy to treat a broader array of cancers will also require harnessing new kinds of tumor-killing particles and finding additional suitable targets.

“There’s a lot of potential here,” says David Nierengarten, an analyst who covers the radiopharmaceutical space for Wedbush Securities in San Francisco. But, he adds, “There’s still a lot of room for improvement.”

Atomic advances

For decades, a radioactive form of iodine stood as the sole radiopharmaceutical available on the market. Once ingested, this iodine gets taken up by the thyroid, where it helps to destroy cancerous cells of that butterfly-shaped gland in the neck — a treatment technique established in the 1940s that remains in common use today.

But the targeted nature of this strategy is not widely applicable to other tumor types.

The thyroid is naturally inclined to absorb iodine from the bloodstream, since this mineral, which is found in its nonradioactive form in many foods, is required for the synthesis of certain hormones made by the gland.

Other cancers don’t have a comparable affinity for radioactive elements. And so, instead of hijacking natural physiological pathways, researchers have had to design drugs that are capable of recognizing and latching onto specific proteins made by tumor cells. These drugs are then further engineered to act as targeted carriers, delivering radioactive isotopes — unstable atoms that emit nuclear energy — straight to the malignant site.

This graphic describes the basics of radiopharmaceuticals.

The first such agents to hit the market were strictly for obtaining images of tissues within the body. Using relatively benign, short-lived isotopes, these products enabled the precise illumination of cancerous tissues on PET scans, helping doctors to diagnose and map the location of malignant cells with greater accuracy. This innovation then paved the way for radiopharmaceuticals equipped with more potent — and lethal — radioactive payloads, now with the aim of not just imaging tumor cells, but killing them.

The strategy took time to establish itself in routine cancer treatment, though.

The first marketed therapy to combine radioactive isotopes with a cell-targeting molecule — a drug called Quadramet, approved by US regulators in 1997 — offered palliative relief for bone pain caused by cancer, but was not designed to shrink tumors. Few clinicians ever bothered to prescribe it.

The early 2000s then saw the arrival of two new drugs for lymphoma, both of which were tagged with radioactive particles and aimed at CD20, a marker on malignant blood cells. Although these drugs worked extremely well in clinical trials, helping to shrink tumors in an overwhelming majority of study participants, they struggled to gain widespread acceptance in clinical practice. Neither could compete against rituximab, a blockbuster nonradioactive medication that also targets CD20, leading to their eventual discontinuation. Neither is available for patients today.

Radiopharmaceuticals offer “a fundamentally different way of treating cancer.”

— GEORGE SGOUROS

Following these commercial setbacks, interest in radiopharmaceuticals diminished and investment in their advancement stalled. “In those days, pharma companies didn’t want to touch radioactive agents with a 10-foot pole — even if that pole was made of lead,” says Neil H. Bander, founder and chief scientific officer of Convergent Therapeutics, a radiopharmaceutical-focused startup based in Cambridge, Massachusetts. “The concept of a radioactive drug was anathema to them.”

But efforts at universities continued, including at Weill Cornell Medicine in New York City, where Bander — who spent 40 years at the medical school and is now an emeritus professor there — began trials with radiolabeled antibody drugs to treat prostate cancer, beginning in 2000.

These drugs were designed to bind a receptor protein found on the surface of prostate cancer cells, known as prostate-specific membrane antigen (PSMA). Once bound, they’re internalized by these cells and deliver their radioactive freight directly to the genetic core of the tumor cells. (Bander cowrote an article discussing this and other PSMA-based therapies in the 2024 Annual Review of Medicine.)

Nuclear options

Around the same time, in Europe, clinicians were making strides in developing radiolabeled agents aimed at another target: somatostatin receptors. These proteins, which are present in rare cancers of the neuroendocrine system, mediate hormone signaling that can drive tumor growth. Researchers discovered that hormone-mimicking molecules loaded with radioactive isotopes would bind to these receptors and shrink tumors effectively.

Clinicians experimented with different radioactive payloads under compassionate-use protocols that allow seriously ill patients to have access to experimental treatments, using unstable forms of elements like yttrium and indium before largely coalescing around an isotope of lutetium. This rare earth metal was preferred for being gentler on the kidneys and having a longer half-life, benefiting manufacturing and logistics. At one clinic in Bad Berka, Germany, over a thousand patients were treated within a decade, showing extended survival rates compared with what’s typical of conventional treatment.

In parallel, several fledgling pharmaceutical companies began establishing the regulatory foundation for wider acceptance. A French firm called Advanced Accelerator Applications (AAA) shepherded one lutetium-labeled drug through randomized trials and, in 2017, reported that this therapy markedly slowed the progression of intestinal tumors compared to the existing standard of care. The drug, marketed as Lutathera, quickly won approval from European and US regulators alike.

That’s when Novartis took notice. Although the Swiss drug giant had dabbled in radiopharmaceuticals in the past, now it was all-in. Within weeks of Lutathera getting the go-ahead in Europe, Novartis swiftly clinched a deal to acquire AAA for nearly $4 billion. A year later, it onboarded a small Indiana firm called Endocyte for over $2 billion more.

“It was like somebody flipped a switch,” Bander says. The industry’s revitalized interest in radiopharmaceuticals had suddenly surged into high gear.

Radiotherapy drugs require special packaging inside lead containers and lined boxes, and swift, precise delivery to the sites where they will be used in treatments.

CREDIT: NOVARTIS

The Endocyte acquisition brought a PSMA-targeted agent that would prove to be a real game-changer — both for patients with certain difficult-to-treat cases of advanced prostate cancer and for Novartis’s bottom line.

In a randomized clinical trial, the drug, when added to standard care, more than doubled the average time before disease progression — from under four months to more than eight — and extended recipients’ lifespans by several months as well.

Lutathera, it should be noted, had shown impressive clinical efficacy as well. But neuroendocrine tumors are rare, and this scarcity means that Lutathera might never achieve the much-coveted “blockbuster” threshold of generating $1 billion in sales per year. By comparison, the PSMA-targeted prostate therapeutic, approved in 2022 under the brand name Pluvicto, addresses a disease so common that about one in seven men will receive a diagnosis during their lifetimes. As such, it came just $20 million shy of reaching blockbuster status less than two years after its market debut.

Beta version

Pluvicto and Lutathera are both built around small protein sequences, known as peptides. These peptides specifically bind to target receptors on cancer cells — PSMA in the case of prostate cancer, and somatostatin receptors in the case of Lutathera — and deliver radiation through the decay of unstable lutetium.

Administered via infusion into the bloodstream, these drugs circulate throughout the body until they firmly attach to the surfaces of tumor cells they encounter. Anchored at these target sites, the lutetium isotope then releases two types of radiation that aid in cancer treatment. The primary emission consists of beta particles, high-energy electrons capable of penetrating tumors and surrounding cells, tearing into DNA and causing damage that ultimately triggers cell death.

Also produced in lesser amounts are gamma rays, which don’t cause much tissue damage but allow healthcare providers to track in real time where the drug is distributed in the body. This allows them to monitor the treatment’s progress and adjust strategies accordingly. “You can actually image where the dose goes and have more understanding,” says Thomas Hope, a nuclear medicine specialist at the University of California, San Francisco, who has consulted for RayzeBio (before its acquisition by BMS earlier this year) in addition to other radiopharmaceutical drugmakers not mentioned in this story.

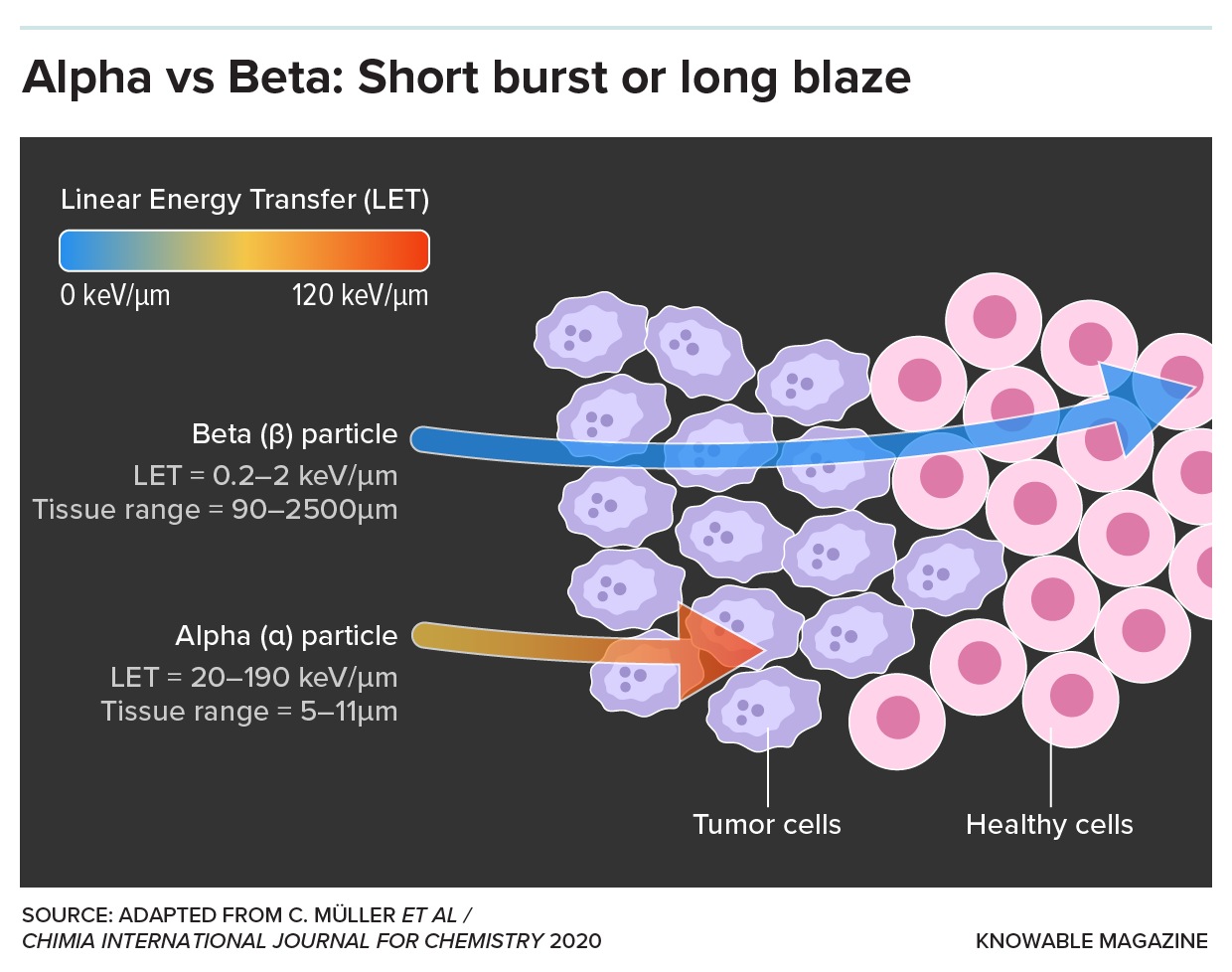

Numerous other therapies now in clinical trials also use radioactive lutetium and other beta-emitting isotopes. But current research efforts and substantial industry investments are progressively shifting toward drugs that rely on alpha-emitting isotopes instead.

Compared to beta particles, alpha particles are larger and more energetic. This feature allows them to shred DNA through breaking both strands of the double helix, leading to highly localized cellular annihilation. “It’s basically like a cannonball going off inside the cell,” says John Valliant, founder and CEO of Fusion Pharmaceuticals, a Canadian company whose alpha-emitting radiopharmaceuticals were the draw for AstraZeneca’s recent takeover of the company.

Another key advantage of alpha particles is their limited travel distance. They tend to penetrate only around 50 to 100 micrometers — roughly the width of a human hair. This stands in stark contrast to beta particles, which can traverse millimeters of tissue before their energy is depleted. As a result, therapies that employ alpha particles achieve highly localized effects: They ravage tumor tissue while sparing nearby healthy cells from injury.

Interest in use of alpha particles in radiopharmaceuticals is growing because the alpha particles can be more precisely targeted to cancerous tissues and have stronger localized cell-killing properties.

Alpha release

Some of the first alpha-emitting radiopharmaceuticals to enter the market will likely be directed against prostate cancer through PSMA. Developers are optimistic that these agents will eventually eclipse Pluvicto, and they are adding extra features to enhance effectiveness.

At Convergent, for instance, Bander and his team are developing a much larger drug based on an antibody that is connected to an alpha-releasing isotope. Because of its size and complexity, the drug remains in the body far longer than peptide-based counterparts, which tend to be quickly removed by the kidneys. That means more time for the drug to find its target and thereby kill tumor cells. Furthermore, alpha-emitting antibodies against PSMA seem to do less damage to salivary glands compared to their peptide counterparts, thus providing a potential added safety benefit.

But the precise cellular destruction of alpha emitters might not always be advantageous, according to Chris Behrenbruch, CEO of Telix Pharmaceuticals in North Melbourne, Australia. The choice of radioactive cargo, he says, should be influenced by the state of the disease and what other therapies the patient is getting through combination drug regimens of the types that are increasingly becoming standard in cancer care.

And as clinicians begin to explore the potential of radiopharmaceutical treatments when they’re paired with other agents that stimulate antitumor immune reactions, Behrenbruch proposes that causing some damage to the surrounding tissue might actually be desirable. That’s because the damage helps to lure in tumor-fighting T cells. “Nothing pisses off your immune system more than healthy tissue being irradiated,” he says.

“Everyone is working on new targets, But which of the new targets is going to be a winner? We don’t know.”

— KEN HERRMANN

Telix is now exploring this hypothesis, conducting clinical trials that combine a lutetium-labeled antibody that targets an enzyme produced by kidney cancer cells with an immunotherapy drug designed to rev up the body’s T cells. By taking aim at a novel target, Telix’s radioactive drug also runs the risk of inflicting collateral damage, given that healthy cells of the stomach, pancreas and gall bladder — not just cancerous cells of the kidney — make the target enzyme, too. Initial trial data indicate that the treatment is generally tolerable, Behrenbruch notes. Still, ongoing research is needed to comprehensively assess its safety profile.

The challenge of specificity — targeting only cancer cells without affecting healthy tissue — is not isolated to this case. Beyond PSMA and somatostatin receptors, the repertoire of proteins exclusively or predominantly expressed by tumor cells is remarkably small, notes Ken Herrmann, a nuclear medicine specialist at University Hospital Essen in Germany. This limited selection complicates the development of therapies that can effectively target tumors without inadvertently imposing undue harm on surrounding healthy tissues, says Herrmann, who consults for most of the major drug companies in the space, in addition to several smaller biotechs.

“Everyone is working on new targets,” he points out. “But which of the new targets is going to be a winner? We don’t know.”

Novartis is among the leaders in the competitive quest to identify the next breakthrough targets. The company is pursuing a new generation of radiolabeled drugs directed against several promising cancer-selective proteins, with some already under clinical evaluation and others in earlier stages of discovery and validation. At the same time, the company is expanding its manufacturing capabilities, with new facilities opening up around the world that are specifically designed for the mass production of radiopharmaceuticals.

It is not like making other kinds of cancer drugs. Supply chain issues are common, as Bristol Myers Squibb discovered earlier this month when a shortage of isotopes compelled the company to temporarily suspend enrollment of patients in a late-stage trial for a radiopharmaceutical agent recently procured from RayzeBio. Furthermore, even when the necessary isotopes are on hand, the swift decay of radioactive material forces companies to operate within a unique logistical framework, with meticulous coordination required between clinicians and manufacturers so that medications arrive at hospitals within tightly defined windows while the therapies remain potent.

Companies generally have a two-week planning window in which to generate a radioisotope, attach it to a targeted drug carrier, and send the therapy off to be administered. It’s not exactly bespoke, made-to-order manufacturing. But it’s not an off-the-shelf product either. It’s somewhere in between, with each dose often made “for a specific patient at a specific time at a specific location,” notes Jeevan Virk, who oversees radiotherapeutic drug development at Novartis.

Earlier this year, Novartis cut the ribbon on a dedicated $100 million manufacturing facility in Indianapolis, where the company plans to churn out hundreds and possibly thousands of doses of Pluvicto every day. It is a far cry from the rudimentary setup of that Chicago light bulb factory where, just a few hours’ drive away, Rose Lee became the first cancer patient treated with X-rays. In these Midwestern sites of innovation, history is radiating forward, connecting past discoveries with future possibilities.

10.1146/knowable-061324-2

TAKE A DEEPER DIVE | Explore Related Scholarly Articles